By Ryan Goertzen | September 26, 2023 0 Comments

Understanding Section 179 Tax Deduction

Section 179 Tax Deduction refers to a special tax incentive designed to motivate and encourage businesses to invest in their growth. This is achieved by allowing companies to deduct the entire equipment purchase price of qualifying capital equipment bought or financed during the tax year. Whether you're a small startup, a midsize business, or a large corporation, understanding and leveraging Section 179 can be a game changer for your business's financial health.

Exploring the Section 179 Tax Deduction

To fully grasp the possibilities that Section 179 offers, let's dive into how it works. First and foremost, to be eligible for this deduction, businesses must purchase, finance, or lease qualifying business equipment and have it put into service by the end of the day on December 31, 2024. The maximum deduction limit for 2024 is a substantial $1,220,000, an increase of $1,160,000 from last year. This annual limit encompasses both new and used qualified equipment, giving businesses flexibility in their purchasing decisions.

Consider Your Packaging Requirements

When it comes to packaging, it's important to consider your specific requirements. One key aspect to keep in mind is the need for proper void fill. This is the material used to fill any empty spaces in a package, keeping the contents safe and secure during transit. Depending on the type of item being shipped or stored, there are various void-fill options available. Additionally, box packaging plays a critical role in ensuring that items arrive safely. Selecting the right box size and durability is crucial to prevent any damage during handling or transport. Overall, careful consideration of packaging needs is vital to maintain quality and protect your products.

Benefits of Section 179

The Section 179 tax deduction is a valuable tool for businesses that want to invest in equipment to help them grow and be more efficient. This tax provision reduces taxable income and allows companies to get a deduction for the entire cost of qualifying equipment in the year it is put into use.

Small and midsize businesses benefit the most from Section 179, as they can now invest in essential equipment and receive immediate financial benefits. This provision also encourages businesses to modernize and stay competitive in their markets. By purchasing new and used equipment, companies can improve their production efficiency, product quality, and customer satisfaction, leading to growth and sustainability.

Section 179 also provides businesses with greater financial flexibility. The tax savings from the immediate expense deduction can be reinvested back into the company for innovation, employee training, or expansion into new markets. This results in a healthier bottom line and overall higher business sustainability.

The tax deduction significantly impacts cash flow by reducing tax liability and allowing businesses to retain more of their earnings. This improves liquidity and gives firms the necessary financial resources to react quickly and effectively to market changes and unexpected business challenges quickly and effectively.

Overall, the Section 179 tax deduction is a strategic tool for business owners to help with smart financial management and long-term business planning. By using this provision, businesses can make significant investments in themselves, fostering scalability and success.

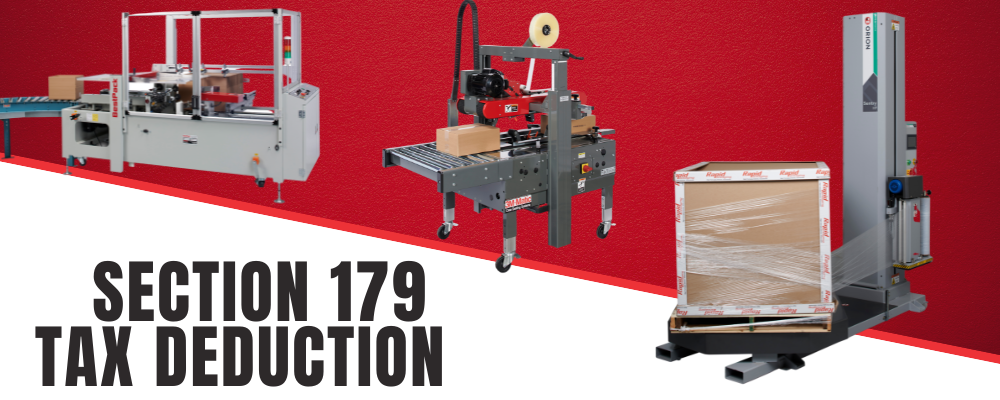

Section 179 and Packaging Equipment

One area of particular interest for businesses considering Section 179 tax benefits is Packaging Equipment. As it stands, both new and used packaging equipment qualify for Section 179, making this a golden opportunity for businesses. The purchase of equipment optimizes operations and could lead to considerable tax savings if carried out before the year's end.

For example, with automated packaging solutions, businesses can save money on labor costs while minimizing their environmental footprint. With the help of automated packaging equipment, companies can reduce their product waste and improve accuracy. Automation solutions lead to cost savings in areas such as inventory control, production speeds, and transport costs associated with shipping products.

In conclusion, Section 179 is a powerful tax benefit incentive that can provide businesses considerable financial benefits. Whether you're just starting with simple automation or looking for a fully automated end-of-line solution – take advantage of section 179 wherever you are in your automation journey! However, consulting with a professional is important to ensure you're taking full advantage of the Section 179 Tax Deduction with this year's current limits.

With the right advice and timely action, businesses can make considerable savings while investing in the future of their operations. Now is a golden opportunity to take advantage of Section 179 and reap the financial benefits that come with it.

Speak with a packaging automation specialist to learn how much you could save in 2024 with Section 179!

About the Author: Ryan Goertzen

Ryan is the Senior Sales Manager at Rapid Packaging, where he helps businesses improve efficiency and performance through innovative packaging and automation solutions. With industry expertise, he delivers practical strategies that reduce costs, minimize labor, and support sustainable growth. Known for his problem-solving, Ryan consistently drives results that make a measurable impact.

When he’s not helping customers optimize their operations, Ryan’s likely watching the Minnesota sports teams or enjoying the outdoors. From fishing and golfing to grilling and camping, he makes the most of all four seasons across the state he calls home.

Need Help?

Increase your productivity with entry-level of full-line packaging automation, reduce packaging costs, and increase product protection with a full catalog of packaging supplies.